- China Insights Weekly | AI, Innovation, Business & Tech in China

- Posts

- VW-Xpeng Expands Alliance 🚗 China Grabs 54% Robots 🤖 Subway 1,000 China Shops 🥪

VW-Xpeng Expands Alliance 🚗 China Grabs 54% Robots 🤖 Subway 1,000 China Shops 🥪

China Insights Weekly for August 18. Unpacking China’s Economic and Technological Advances.

Welcome back to this week’s edition of the China Insights Weekly Newsletter!

Here are some of the key highlights for this week’s edition:

Fosun Pharma secures USD 645M deal for novel lung disease drug rights

Chinese smartphone brands dominate India and Southeast Asia with over 70% market share

China’s concert economy grows 7x in two years, fueling wider local spending

World’s first phased array CT scanner enters clinical trials in Shanghai

Dive deeper into these stories and more by clicking the headlines below. We value your feedback. Let us know your thoughts or suggestions on LinkedIn, X or Facebook.

🚀 Headlines

XPeng and Volkswagen Group have expanded their partnership to develop a next-generation electrical and electronic (E/E) architecture for vehicles in China. This architecture will be integrated into Volkswagen's BEV platform and deployed on its gasoline and plug-in hybrid platforms, significantly increasing the scale of models equipped with the joint E/E architecture in the Chinese market. The collaboration aims to accelerate software iteration and over-the-air (OTA) updates, shortening vehicle development cycles and achieving significant platform-driven economies of scale. This move supports Volkswagen's software-defined car strategy and enhances its global competitiveness.

US sandwich chain Subway has opened its 1,000th store in China, marking a significant milestone in its expansion. The company aims to reach 4,000 stores within the next 20 years and has set an ambitious internal target of 10,000 outlets. Subway entered the Chinese market in 1995 and has since adopted a direct ownership model to accelerate growth. The brand plans to open 300 to 500 new stores annually, leveraging China's world-leading food processing capabilities and localized supply chain. Subway's rapid expansion is supported by its localization strategy, which includes local procurement, research and development, and supply chain management.

Shares of Fosun Pharmaceutical Group rose by 3.4% to close at CNY27.70 (USD3.85) per share after the company announced that a subsidiary had agreed to sell the rights to an innovative treatment for chronic lung diseases outside of mainland China, excluding Hong Kong and Macao, for up to USD645 million. The deal involves the global market development, production, and commercialization rights for XH-S004, a small-molecule oral dipeptidyl peptidase 1 inhibitor, with potential indications including non-cystic fibrosis bronchiectasis and chronic obstructive pulmonary disease (COPD). Under the agreement with US biotech firm Expedition, Fosun will receive up to USD120 million in phased non-refundable down payments and up to USD525 million in milestone payments based on net sales and performance. Fosun has invested CNY72 million (USD10 million) in the research and development of XH-S004, which is currently in Phase II clinical trials for non-CF bronchiectasis and Phase Ib trials for COPD in China.

You wouldn’t allow unmanaged devices on your network, so why allow unmanaged AI into your meetings?

Shadow IT is becoming one of the biggest blind spots in cybersecurity.

Employees are adopting AI notetakers without oversight, creating ungoverned data trails that can include confidential conversations and sensitive IP.

Don't wait until it's too late.

This Shadow IT prevention guide from Fellow.ai gives Security and IT leaders a playbook to prevent shadow AI, reduce data exposure, and enforce safe AI adoption, without slowing down innovation.

It includes a checklist, policy templates, and internal comms examples you can use today.

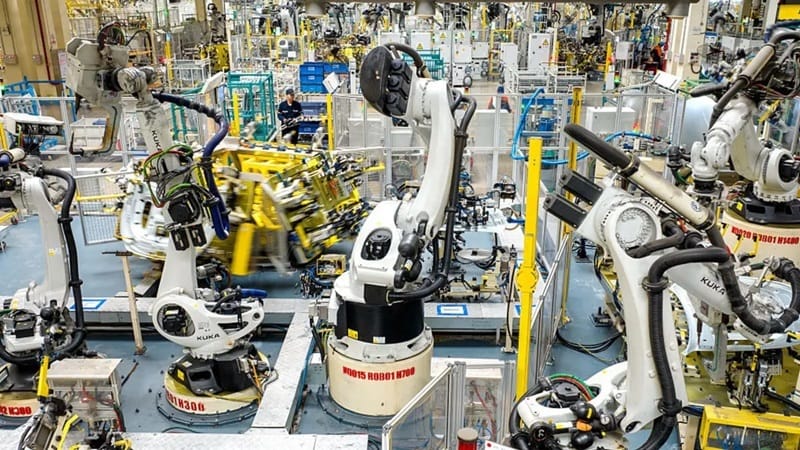

China’s industrial robots grow 5% and reach 54% of global market as installations decline in US, EU, and Japan (link)

China's industrial robot installations increased by 5% in 2024, reaching approximately 290,000 units, which accounted for 54% of the global total. This growth contrasts with declines in other major markets: Japan's installations dropped by 7% to 43,000 units, the US fell by 9% to 34,000 units, and the EU decreased by 6% to 86,000 units. China's robot density, measured as the number of industrial robots per 10,000 workers, nearly doubled from 246 in 2020 to 470 in 2023, moving it from ninth to third place globally. In the first half of 2025, China's industrial robot production surged by 35.6% year-on-year, reaching nearly 370,000 units. This expansion is part of China's broader push to upgrade its manufacturing through automation, shifting from labor-intensive to technology-driven growth.

Chinese smartphone brands dominate India, and South East Asia with over 70% market share (link, link)

India's smartphone market grew by 7% year-on-year in Q2 2025, reaching 39.0 million units despite a sluggish start to the year. This growth was driven by new product launches and easing inventory challenges. Vivo led the market with 8.1 million units shipped and a 21% market share, followed by Samsung with 6.2 million units and 16%. OPPO shipped 5 million units, edging past Xiaomi, which also shipped 5 million units. Another Chinese brand, Realme, completed the top five with 3.6 million units.

In Q2 2025, Southeast Asia's smartphone market declined by 1% year-on-year to 25.0 million units. Xiaomi reclaimed the top spot for the first time since Q2 2021, shipping 4.7 million units and capturing a 19% market share, an 8% increase from the same period last year. This growth was driven by strong Redmi series sales and expanded channel reach. TRANSSION climbed to second place with 4.5 million units and an 18% market share, recording a robust 17% year-on-year increase. Samsung ranked third with 4.3 million units and a 17% market share, down 3% year-on-year. OPPO (excluding OnePlus) was fourth with 3.5 million units and a 14% market share. Vivo rounded out the top five, taking an 11% market share.

China's concert economy is booming, with a significant shift in its audience demographics and economic impact. In 2025, ticketing platform Damai saw its revenues soar from RMB 228 million (USD 31.9 million) in 2023 to RMB 2.06 billion (USD 288.4 million). The average per capita disposable income in China was RMB 40,000 (USD 5,600) in 2024, with only RMB 3,189 (USD 446.5) allocated annually for education, culture, and entertainment, making concert tickets a luxury. Despite high ticket prices, demand persists, with fans willing to pay thousands for a few hours of music. The concert economy extends beyond music, filling hotels, restaurants, and shopping centers. In Taiyuan, 32 concerts in 2024 generated RMB 4.1 billion (USD 574 million) in consumption, with ticket sales accounting for just RMB 1.04 billion (USD 145.6 million). The China Association of Performing Arts reports that every RMB 1 (USD 0.14) spent on a ticket fuels an additional RMB 4.8 (USD 0.67) in related local spending. This trend is driven by a diverse audience, including middle-aged professionals, retirees, and parents, reflecting a cultural shift and economic opportunity.

Five balloons at Chaoyang Park in Beijing represent members of the Taiwanese band Mayday

China launched its eighth batch of satellites for the Guowang broadband network on August 13, 2025, from the Wenchang Space Launch Center on Hainan Island. The mission, carried by a Long March 5B rocket, was a complete success, according to the state-owned China Aerospace Science and Technology Corporation (CASC). Guowang, operated by China Satnet, aims to eventually consist of 13,000 satellites. Each launch currently deploys eight to ten satellites, significantly fewer than SpaceX's Starlink missions, which launch 24 to 28 satellites per mission. Despite this, China is accelerating the pace of its launches; the August 13 launch was the fourth in less than three weeks. Guowang is one of several Chinese broadband megaconstellations in development, with another project, Qianfan, also aiming to reach a similar scale.

A Chinese Long March 5B rocket launches the eighth batch of satellites for the Guowang internet megaconstellation from Hainan Island

The world's first phased array computed tomography (CT) scanner, developed by Chinese high-tech firm NanoVision Technology, has been installed at Shanghai's Ruijin Hospital for clinical trials. This innovative device offers ultra-high-definition (UHD) imaging with a resolution of 3072x3072, significantly exceeding the 512x512 resolution of conventional CT images. The scanner uses a unique pulsed exposure scanning method and advanced algorithms to achieve UHD imaging while reducing radiation dose by over 50%. The technology is expected to enhance the accuracy of early disease diagnosis and improve the precision of orthopedic minimally invasive surgeries. NanoVision aims to obtain a Class III medical device certificate by the end of the year, which could boost the related supply chain.

📸 China Snapshot

Xiamen from above reveals a tapestry of rivers, bridges, and urban islands that reflect the city’s long-standing role as a maritime gateway. With roots in international trade dating back to the Song dynasty, Xiamen today is a modern port city shaped by global connections and a strong overseas Chinese presence.

Photo by Yereth Jansen

🎁 Bonus Stories

China has introduced a new visa category, the K visa, designed to facilitate the entry of young foreign experts in science, technology, engineering, and mathematics (STEM) fields for research, exchange, and business purposes. Effective from October 1, the K visa offers more convenience in terms of the number of entries, validity period, and length of stay compared to existing visa categories. The visa will be issued to young professionals with a bachelor's degree or above in STEM fields from well-known universities and research institutions, or those engaged in relevant professional education or research. Unlike other visas, the K visa does not require a job offer or invitation from within China, making the application process more accessible. Specific conditions and requirements will be published on the websites of Chinese embassies and consulates abroad. This initiative is part of China's broader efforts to attract and retain global talent in key technological fields.

China hosted the first World Humanoid Robot Games in Beijing, featuring an Olympic-style competition for robots at the National Speed Skating Oval and National Stadium. The event, which began on August 15, 2025, saw 280 teams from 16 countries, including Japan, Germany, and the US, bring over 500 two-legged robots to compete in 26 events, ranging from athletics and boxing to service-oriented tasks such as medicine sorting and hotel cleaning. Notable achievements included the world’s first fully autonomous five-a-side soccer match for humanoids and a 1,500-meter run completed by Unitree Robotics’ H1 model in 6 minutes and 34 seconds. The event served as both a public showcase and a large-scale field test for embodied artificial intelligence, with data collected on collisions, endurance, and cooperative play feeding back into practical applications. Tickets for the event ranged from 128 to 580 yuan ($18–81).

☕ Support our work

If you enjoy our newsletter, please consider buying us a coffee to keep us energized in bringing you the latest insights! 🤓☕

👥 About us

China Insights is brought to you by Tomas Kucera, GM at Gemini Personnel in Shanghai, and Yereth Jansen, CEO at Darling Advertising + Design in Shanghai.

Reply