- China Insights Weekly | AI, Innovation, Business & Tech in China

- Posts

- VW’s China EV Lab ⚡ Debris Warning Satellite 🛰️ China’s Pharma Push 💊

VW’s China EV Lab ⚡ Debris Warning Satellite 🛰️ China’s Pharma Push 💊

China Insights Weekly for December 1. Unpacking China’s economic and technological advances.

Welcome back to China Insights Weekly. Here are some of the key highlights for this week’s edition:

Yum China targets 30,000 stores by 2030, speeding up low-cost formats like Pizza Hut WOW

Foreign investors pivot to Shanghai tech, with Hong Leong committing USD 71 million

Qwen AI hits 10 million downloads in one week, signaling surging consumer appetite for local AI apps

China dominates global polysilicon output, providing nine of the world’s top ten producers

🚀 Headlines

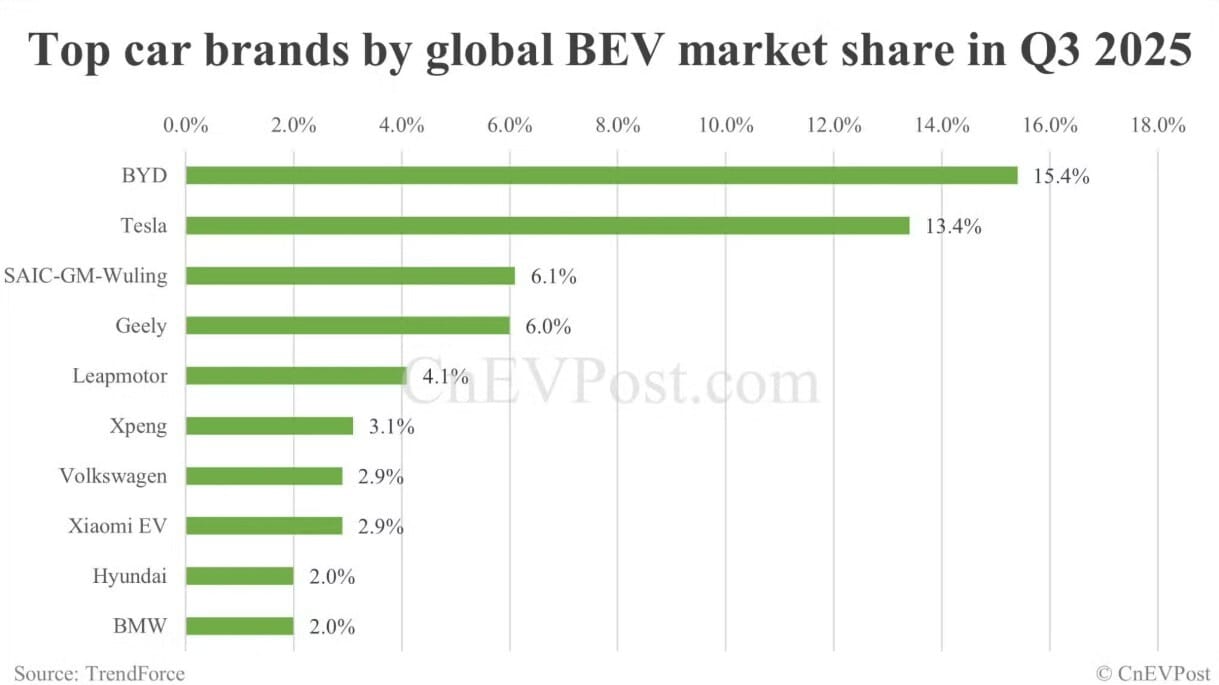

BYD leads global BEV market with 15.4% share in Q3, followed by Tesla at 13.4%, VW opens first EV-only dev center in China (link, link)

In Q3 2025, BYD led the global battery electric vehicle (BEV) market with a 15.4% share, selling 582,522 passenger BEVs, which is a 31.37% year-on-year increase but a 4.03% decline from Q2. Tesla ranked second with a 13.4% share, posting 7.4% year-on-year increase and 29% quarter-on-quarter sales growth. In the global plug-in hybrid electric vehicle (PHEV) market, BYD maintained its leading position with a 27.9% market share, selling 523,069 units, down 23.73% year-on-year but up 0.56% from Q2. Global new energy vehicle (NEV) sales reached 5.39 million units in Q3, a 31% year-on-year increase, with BEV sales at 3.71 million units (up 48% year-on-year) and PHEV sales at 1.67 million units (up 4% year-on-year).

Volkswagen has launched its first EV-only development center outside Germany, marking a strategic milestone in its localization efforts. The facility, located in Hefei, Anhui province, spans 100,000 square meters and houses over 100 advanced laboratories. It aims to cut vehicle development time by 30 percent and reduce costs of key projects by up to 50 percent. The center will focus on electric, intelligent, and connected vehicles, integrating core development units with local decision-making. It will also coordinate closely with joint ventures and support Volkswagen’s “In China for China” strategy. Up to 500 battery systems will be tested each year, covering performance, longevity, safety, and environmental resilience.

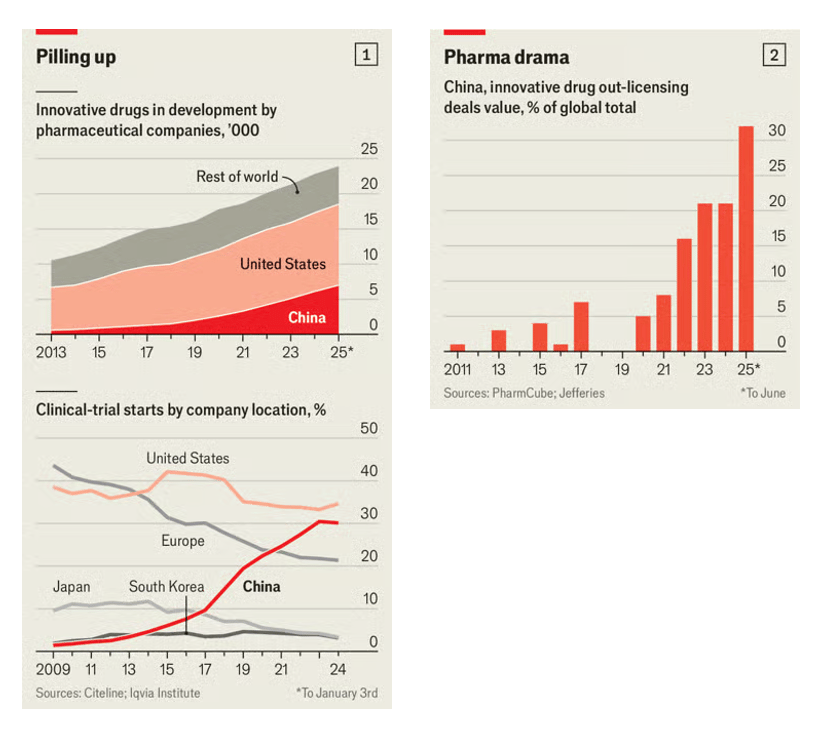

Chinese pharma is going global with 3rd of global licensing and clinical trials, ranks 2nd globally in CART-T clinical trials and cases (link, link)

China now runs a third of the world’s clinical trials, up from just 5% a decade ago. Biotech shares have surged 110% this year, driven by rising innovation and big pharma’s search for new molecules as USD 300 billion in drug patents expire by 2030. In H1 2025, nearly a third of global licensing deals signed by major pharma firms were with Chinese compan es, a fourfold jump since 2021. A growing trend is the “NewCo” model, where Chinese biotechs spin off US-based ventures to commercialize promising drugs, often backed by foreign investors.

China, which ranks second globally in CAR-T clinical trials and treated cases, offers the therapy at significantly lower costs than in the West—often one-third to one-half as much—without compromising safety or efficacy. Recently, a 78-year-old New Zealander traveled to China for CAR-T therapy, a form of immunotherapy that genetically engineers a patient’s immune cells to combat cancer. The patient had exhausted conventional treatments for high-risk multiple myeloma and chronic kidney disease. The patient underwent two stages of treatment in Shanghai: T-cell collection and CAR-T infusion, with initial blood tests showing positive results.

Learn how to make every AI investment count.

Successful AI transformation starts with deeply understanding your organization’s most critical use cases. We recommend this practical guide from You.com that walks through a proven framework to identify, prioritize, and document high-value AI opportunities.

In this AI Use Case Discovery Guide, you’ll learn how to:

Map internal workflows and customer journeys to pinpoint where AI can drive measurable ROI

Ask the right questions when it comes to AI use cases

Align cross-functional teams and stakeholders for a unified, scalable approach

Yum China, operator of KFC and Pizza Hut restaurants in China, plans to have over 30,000 stores by 2030, up from 17,514 at the end of September, aiming to boost its restaurant margin to at least 16.7% by 2028 from 16.3% this year. Yum China plans to return 100% of its free cash flow after dividend payments to non-controlling interests of its subsidiaries from 2027 onwards, translating into an average annual return of USD 900 million to over USD 1 billion in 2027 and 2028, and exceeding USD 1 billion in 2029. The company's Pizza Hut WOW store format, launched last year, typically costs just 650,000 yuan (USD91,000) to 850,000 yuan each to open, far less than traditional stores costing up to 1.2 million yuan.

Singapore's Hong Leong to invest USD 71 million in Shanghai tech sector, Chinese startups increasingly turn to local governments for financing (link, link)

Singapore’s Hong Leong Group is investing CNY500 million (USD 70.6 million) in Shanghai’s technology sector through its Star River fund, using a Qualified Foreign Limited Partner (QFLP) structure to join the Phase III Sci-Tech Innovation Center Fund. The QFLP scheme allows approved overseas firms to convert foreign currency into yuan and invest in domestic funds, expanding access to China’s high-tech growth sectors. The move supports Shanghai’s ambition to become a global innovation hub while offering stable capital to scaling startups.

Meanwhile, Chinese startups are increasingly relying on local government capital as overseas VC pulls back amid US-China tensions. Foreign funding accounted for just over 10% of startup financing in the first eight months of 2025, down from 50% in 2018. Z.ai, formerly Zhipu AI, exemplifies this shift. Its shareholders include municipal government funds from Beijing and Shanghai, plus Alibaba. Despite US export restrictions, its IPO would signal Beijing’s broader push to back early-stage strategic tech.

Alibaba's Qwen AI chatbot achieved 10 million downloads within its first week of launch as a public beta app in China. This rapid growth outpaces rivals like ChatGPT, which reached one million users in five days three years ago. Qwen, powered by Alibaba's Qwen3 family of models, specializes in deep research, vibe coding, AI-powered camera features, and slide deck generation. The app aims to integrate core lifestyle and productivity services such as food delivery, health guidance, and travel booking. Alibaba plans to expand Qwen's capabilities to handle a wide array of real-world tasks, positioning it as a proactive life and work assistant.

China’s leading economic regions include the Yangtze River Delta, the Beijing-Tianjin-Hebei region, and the Greater Bay Area. These three account for 90 percent of the country’s pre-unicorn tech firms. Of the 100 firms identified, 59 are in the Yangtze River Delta, 17 in the Beijing-Tianjin-Hebei region, and 14 in the Greater Bay Area. Shanghai leads with 18 pre-unicorns, followed by Beijing with 17, Suzhou with eight, Shenzhen with seven, and both Guangzhou and Nanjing with six. These high-growth firms, each valued under USD 1 billion, are concentrated in sectors such as integrated circuits, biomanufacturing, autonomous driving, new energy, artificial intelligence, robotics, and commercial aerospace. Shanghai offers a complete chip supply chain from design to high-end manufacturing equipment. Suzhou supports the ecosystem with strong capabilities in IC packaging, testing, and manufacturing.

Chinese firms dominate the global polysilicon market, accounting for nine of the top ten producers in 2024. Polysilicon is primarily used in the production of solar photovoltaic cells and serves as a key raw material for manufacturing the silicon wafers that form the basis of most solar panels. Tongwei leads with a production capacity of 910,000 metric tons, nearly double that of second-placed GCL Technology at 480,000 metric tons. The top four manufacturers hold 65% of the market share. China's polysilicon industry reached a global output share of 93.5% in 2024. Despite efforts to cut production capacity due to oversupply, polysilicon prices have collapsed from USD 39/kg in 2022 to less than USD 4.50/kg. The report suggests that prices are unlikely to recover above USD 5/kg by 2027, indicating ongoing financial challenges for the industry.

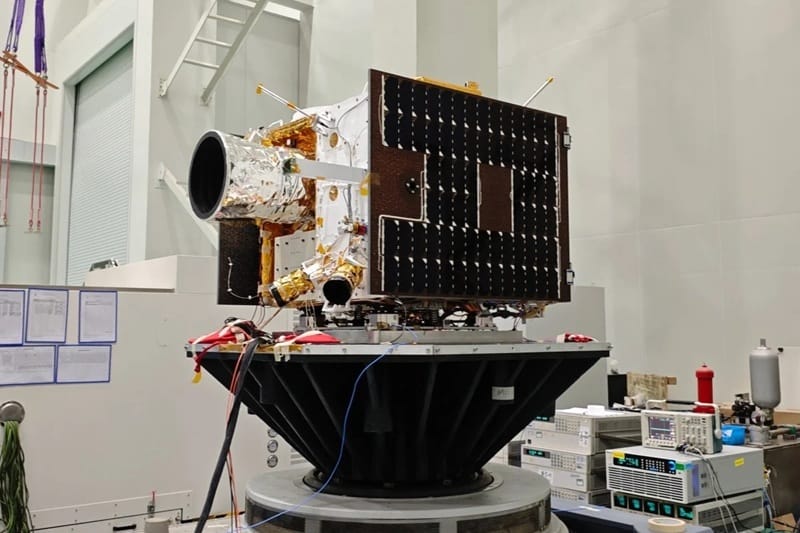

China plans to launch a "Star Eye" (Xingyan) satellite network consisting of 156 satellites to monitor space debris and provide collision warnings. The network, developed by Geovis Insighter Technology and backed by the Chinese Academy of Sciences, aims to safeguard space stations, spacecraft, and satellites. The satellites will be launched starting in the first half of 2026 to form a global, near-Earth monitoring network. 12 satellites would be launched by 2027 and the full network in operation after 2028. The system will track in-orbit spacecraft and debris in real time, offering end-to-end data support for commercial satellite operators, governments, and research institutions. This initiative addresses the growing issue of space congestion, with the number of satellites and debris increasing sharply due to the booming commercial aerospace sector. China's commercial aerospace industry reached CNY 2.3 trillion (USD 325 billion) in 2024 and is expected to grow to CNY 2.8 trillion this year.

📸 China Snapshot

Beijing’s CBD with China Zun, officially the CITIC Tower, towering over the skyline. At 528 meters, China Zun is the tallest building in the capital and the core landmark of Chaoyang District, the city’s business and diplomacy center. On the right is the CCTV Headquarters, one of China’s most iconic pieces of contemporary architecture and a global favorite in design circles.

Photo by Yereth Jansen

🎁 Bonus Stories

Lin Wenbin, a world-leading cancer drug scientist and pioneer in the field of metal-organic frameworks (MOFs), has joined Westlake University in Hangzhou, China, as a full-time chair professor and head of the molecular materials laboratory for sustainable development and human health. Lin, who was previously a James Franck professor of chemistry at the University of Chicago and part of its department of radiation and cellular oncology, has made significant contributions to developing more effective cancer treatments. His move follows a trend of top Chinese scientists returning to China. Lin's work includes two MOFs currently in clinical development for cancer treatment, both originating from his research.

Zootopia 2 gets to record-breaking start in China; Biggest opening day ever for a US animated movie (link)

Disney's "Zootopia 2" is on track to gross over USD 525 million worldwide through Sunday. As of Friday, the worldwide total reached USD 233 million, with international box office accounting for $135.3M. China has been a significant driver, with "Zootopia 2" achieving the biggest opening day for a U.S. animated film ever, at USD 34 million on Wednesday. The film's Saturday numbers increased by 160% over Friday, overtaking "Avengers: Endgame" for the biggest single-day gross for a Hollywood movie in China. The top 5 markets through Friday were China (USD 94.2 million), Korea (USD 4.6 million), France (USD 4.5 million), Mexico (USD 3.7 million), and Germany (USD 2.8 million).

👥 About us

China Insights is brought to you by Tomas Kucera, General Manager at Sino Matters, and Yereth Jansen, CEO at Darling Advertising + Design in Shanghai. Also follow us on LinkedIn, X or Facebook.

Reply