- China Insights Weekly | AI, Innovation, Business & Tech in China

- Posts

- Uber x Baidu Goes Global 🚘 $1B Air Taxi Deal ✈ China VC Comeback 💰

Uber x Baidu Goes Global 🚘 $1B Air Taxi Deal ✈ China VC Comeback 💰

China Insights Weekly for July 21. Unpacking China’s Economic and Technological Advances.

Welcome back to this week’s edition of the China Insights Weekly Newsletter!

Here are some of the key highlights for this week’s edition:

BMW opens its largest Asia IT hub in China with a focus on AI

New Chinese battery retains 100% capacity after 350 cycles

Beijing Stock Exchange becomes China's top IPO hub with 113 applications

China's exports to ASEAN & EU grow, filling US trade gap

Dive deeper into these stories and more by clicking the headlines below. We value your feedback. Let us know your thoughts or suggestions on LinkedIn, X or Facebook.

🎁 Support us and earn exclusive rewards – click here to share with your friends

🚀 Headlines

Beijing-based Baidu has partnered with US ride-hailing giant Uber to deploy its autonomous cars on Uber's platform outside the US and mainland China. The first deployments are expected in Asia and the Middle East later this year, with thousands of Baidu's Apollo Go autonomous vehicles planned for global integration. This move internationalizes Baidu's driverless car business and provides Uber with a proven partner to compete in the autonomous driving market. Baidu has been operating its robotaxi service in major Chinese cities since 2021. It now operates in 11 cities in China and plans to expand into Dubai and Europe. Uber, which sold its autonomous vehicle unit in 2020, benefits from Baidu's technology and global reach.

Chinese startup TCab Technology has secured a record USD 1 billion deal to supply 350 of its E20 electric vertical take-off and landing (eVTOL) aircraft to UAE-based air mobility company Autocraft. This marks the largest single order for such vehicles from a Chinese supplier. The E20, with a 12-meter wingspan and tilt-rotor configuration, can travel up to 200 kilometers at a top speed of 320 km/h, carrying a pilot and four passengers. The first batch will be delivered after obtaining airworthiness certification from China's Civil Aviation Administration. This partnership aims to leverage Autocraft's local resources and TCab's expertise in eVTOL development, pushing for pilot project deployments and commercial rollouts. The global eVTOL market is projected to reach nearly $30 billion by 2030, highlighting the growing confidence in the commercial viability of air taxis.

German automaker BMW is set to establish its first IT research and development center in China, located in Nanjing's Jianye District. The new entity, BMW (Nanjing) Information Technology Co., Ltd., will focus on AI, industrial digital twins, and intelligent manufacturing. Once operational, it will be BMW's largest IT R&D hub in Asia, aimed at strengthening the company's global production, sales, and after-sales systems through digital solutions. In 2024, BMW's AI tool "JoyCode" achieved a 30% assisted code generation rate, boosting delivery efficiency by the same margin. BMW is also collaborating with Chinese tech firms like Momenta, Alibaba, and DeepSeek to develop advanced driver-assistance systems and AI engines. The center will serve as a talent hub, recruiting and training digital professionals and working with local governments, universities, and startups to drive open collaboration in AI and smart connected vehicles.

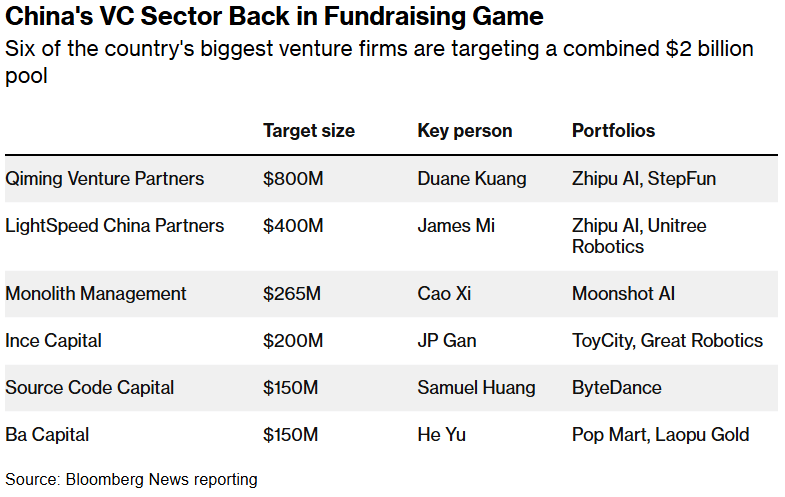

At least six of China's leading venture capital (VC) firms are raising new dollar-denominated funds, targeting a combined total of at least USD 2 billion. This fundraising wave includes LightSpeed China Partners, aiming for USD 400 million focused on deep tech, and Monolith Management, seeking USD 265 million for its second fund. Other firms like BAI Capital, Ince Capital, Source Code Capital, and Ba Capital are also raising significant funds. This resurgence reflects global investors' renewed interest in China's startup landscape and broader economy, showing signs of revival after years of Covid-era stagnation and regulatory challenges. The interest is driven by the rise of AI stars like DeepSeek and successful consumer brands such as Laopu Gold and Pop Mart. Despite lingering concerns about geopolitical tensions, global sovereign wealth investors managing USD 27 trillion are increasingly bullish on China's tech sector, according to an Invesco Asset Management survey.

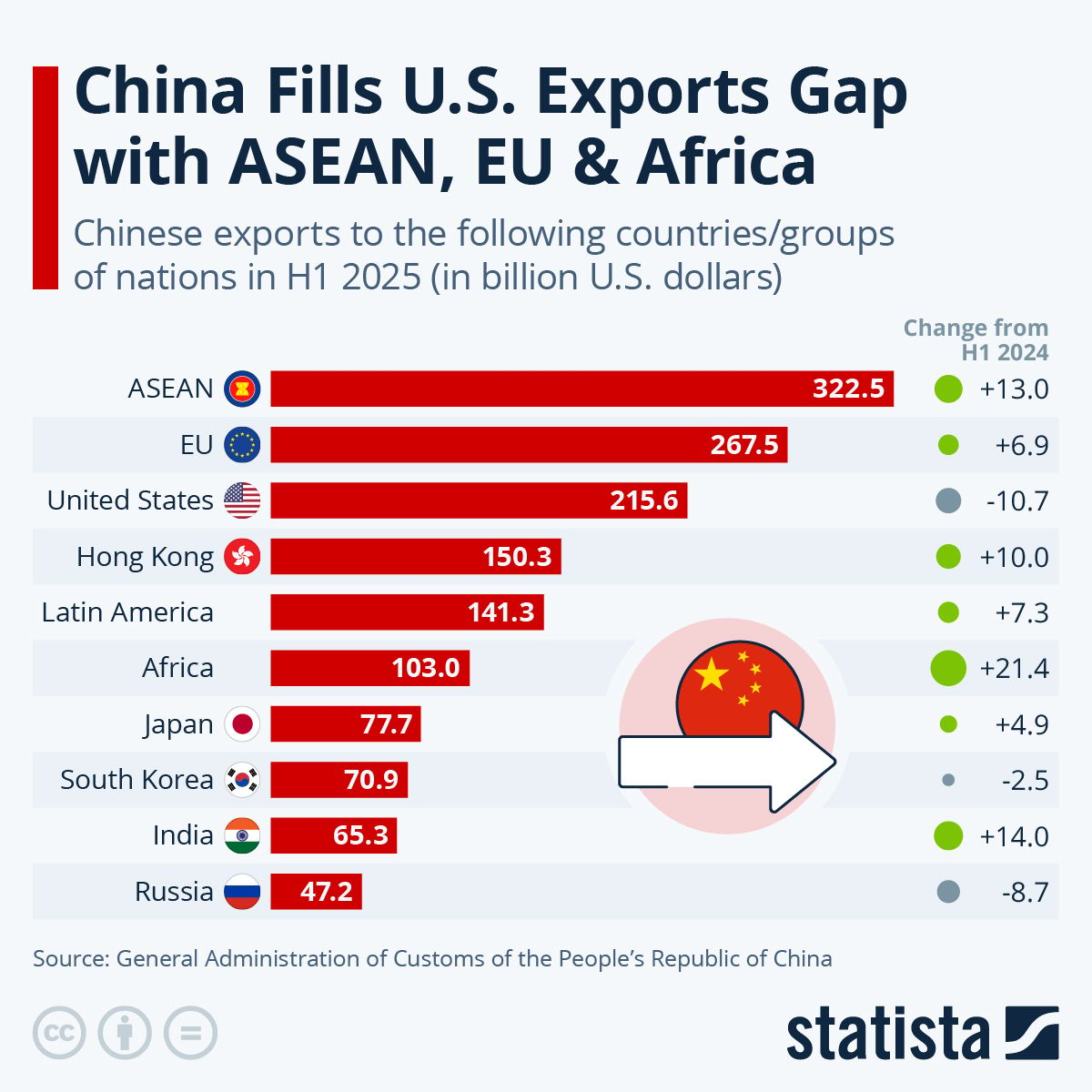

China saw a 10.7% drop in exports to the United States in the first half of 2025 compared to the same period in 2024. According to customs data, this amounts to a decrease of around USD 25.7 billion. Chinese exports to other countries and groups of nations have filled this gap. Exports to the ASEAN countries rose 13% from the same period a year ago, reaching USD 37.1 billion. Exports to the European Union increased by 6.9% (+USD 16.3 billion), and exports to countries in Africa rose by 21.4% (+USD 18.2 billion). China has rerouted some of its exports to the U.S. through new manufacturing hubs, such as Vietnam, Mexico, and India, which have become key sources of final assembly for electronics. At the same time, China continues to produce the parts that power these goods. In H1 2025, despite the drop in exports, the U.S. still remained one of China’s biggest trading partners, accounting for USD 215.6 billion of Chinese exports (11.9% of total Chinese exports).

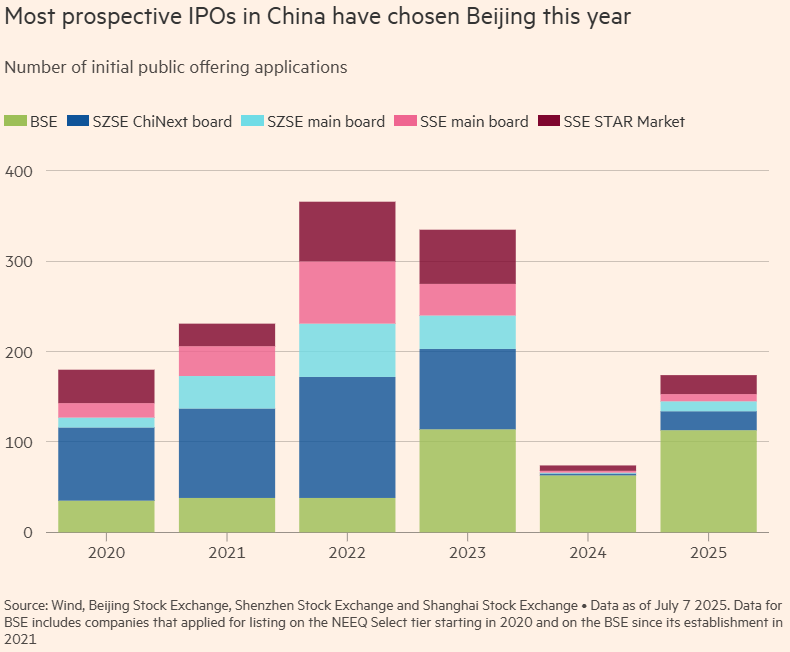

The Beijing Stock Exchange (BSE), established in 2021, has emerged as a significant IPO hub, receiving 113 applications for initial public offerings in 2025, surpassing the combined total of Shanghai and Shenzhen. This surge is driven by looser listing requirements and a renewed interest in small-cap technology stocks, particularly following the AI boom led by companies like DeepSeek. The BSE's 50 index has risen 37.6% this year, compared to 2.5% for China's benchmark CSI 300. The exchange aims to serve innovative small and medium-sized enterprises (SMEs) by providing alternative financing for unprofitable but innovative businesses. Despite initial challenges with liquidity, the BSE is now seen as a major force, with a promising long-term outlook for both the number and quality of listings. The exchange's relaxed IPO requirements make it an attractive option for tech firms, and its ecosystem of research, policy, and finance is enhancing its appeal.

Chinese scientists have developed a composite electrolyte that significantly enhances battery performance. The fluorine-grafted quasi-solid composite electrolyte, known as F-QSCE@30, was created by researchers from Luleå University of Technology and the Chinese Academy of Sciences. This electrolyte improves ionic conductivity by a 15× over previous fluorinated systems. The innovation also addresses safety concerns by replacing conventional organic electrolytes with a UV-cured, glass-fiber-reinforced membrane that is non-flammable and mechanically robust. The study, published in Nano-Micro Letters, shows that F-QSCE@30 maintains nearly 100% capacity after 350 cycles at 0.5 C and 60°C. This development meets 2030 USABC targets for capacity retention and rate capability, paving the way for high-energy-density batteries suitable for electric vehicles and grid storage.

Highly electronegative fluorine atoms pull electron density away from carbonyl oxygens

China has launched the world's first 1,000-ton-scale ionic liquid cellulose fiber plant in Henan Province, marking a significant step towards sustainable textile production. Developed by the Institute of Process Engineering at the Chinese Academy of Sciences, the plant uses advanced ionic liquid technology to produce regenerated cellulose fibers with near-zero emissions. This process eliminates the need for toxic solvents like carbon disulfide and N-Methylmorpholine N-oxide (NMMO), reducing the carbon footprint and eliminating wastewater, waste gas, and solid byproducts. The plant is expected to cut CO₂ emissions by approximately 5,000 tons annually. The solvent recovery system exceeds a 99% recovery rate, further enhancing its environmental credentials. This achievement follows over a decade of research and development, setting a new benchmark for green industrialization and contributing to China's dual carbon goals.

🏆 Invite Friends. Get China Insights Rewards.

To be eligible for China Insights Rewards, subscribe to our newsletter first.

📸 China Snapshot

This view from Gulangyu Island looks across the Lujiang Strait towards the modern skyline of Xiamen in Fujian province. Gulangyu, a UNESCO World Heritage Site officially named Kulangsu, is famed for its unique collection of European colonial architecture, a legacy of its past as an international settlement established after the Treaty of Nanking in 1842. Notably vehicle-free, the island is also celebrated as the "Island of Pianos" for its rich musical heritage and China's only piano museum, offering a preserved glimpse into a unique chapter of history.

Photo by Darry Lin

🎁 Bonus Stories

Citizens of 130 countries can enter China visa-free with the addition of Azerbaijan, visa-free entries up 53.9% (link, link)

China has expanded its visa-free travel policy, effective July 16, 2025, which allows citizens of 75 countries to stay for up to 30 days. Adzerbaijan is the latest country to be added to the expanding list. This initiative aims to boost tourism and business, supporting China's post-COVID-19 economic recovery. The policy covers tourism, family visits, business, exchange visits, and transit, with ordinary passports being eligible. In 2024, over 20 million foreign travelers entered China visa-free, accounting for nearly one-third of all international arrivals. In the first half of 2025, visa-free entries made by foreign nationals increased by 53.9% and reached 13.64 million, accounting for 71.2% of the total entries by foreign nationals. China offers a 240-hour (10 days) visa-free transit option for travelers from 55 countries at 60 ports. Therefore, citizens of 130 countries can enter China without a visa.

"Sultan’s Game," a card-based role-playing game developed by a small team, has become a significant hit in China and on the international platform Steam. The game has generated USD 12.4 million in revenue, selling over 660,000 copies, a remarkable feat compared to the typical indie game success benchmark of 20,000 copies. The game's unique narrative and visual style, inspired by Middle Eastern Islamic aesthetics, have contributed to its popularity. It has also become a viral topic on platforms like Xiaohongshu and Bilibili, with nearly 100,000 posts related to the game. The game's success is attributed to its high quality, engaging narrative, and visual presentation, rather than traditional marketing efforts. The game's launch on Steam, a global platform with a growing Chinese user base, has also played a crucial role in its commercial performance.

☕ Support our work

If you enjoy our newsletter, please consider buying us a coffee to keep us energized in bringing you the latest insights! 🤓☕

👥 About us

China Insights is brought to you by Tomas Kucera, GM at Gemini Personnel in Shanghai, and Yereth Jansen, CEO at Darling Advertising + Design in Shanghai.

Reply