- China Insights Weekly | AI, Innovation, Business & Tech in China

- Posts

- JD Buys MediaMarkt 📦 AI Monkey Brain 🐒 ByteDance Leads AI Video 🎬

JD Buys MediaMarkt 📦 AI Monkey Brain 🐒 ByteDance Leads AI Video 🎬

China Insights Weekly for August 4. Unpacking China’s Economic and Technological Advances.

Welcome back to this week’s edition of the China Insights Weekly Newsletter!

Here are some of the key highlights for this week’s edition:

Chinese pharma firms win major FDA approval and a USD 2.1B licensing deal

Generative video AI drives revenue as ByteDance and MiniMax lead global rankings

Green hydrogen pipeline launches from Inner Mongolia to Beijing for industrial use

China’s renewables boom adds 268 GW in H1 2025, led by record solar installations

Dive deeper into these stories and more by clicking the headlines below. We value your feedback. Let us know your thoughts or suggestions on LinkedIn, X or Facebook.

🎁 Support us and earn exclusive rewards – click here to share with your friends

🚀 Headlines

China's JD.com to buy Europe’s leading electronics retail brands, Germany's Ceconomy for USD 2.5 billion (link)

JD.com, one of China’s largest e-retailers ($160B revenue), is acquiring Germany’s Ceconomy for €2.2B ($2.5B). The deal gives JD control of MediaMarkt and Saturn, two of Europe’s biggest consumer electronics chains, with ~1,000 stores across the continent. Ceconomy’s 2023/24 sales reached €22.4B, with €5.1B online. Completion is expected in H1 2026. JD has been expanding globally: launching Ochama in the Netherlands (2022) and piloting Joybuy in the UK (2024). Chinese M&A in Europe more than doubled to $8.45B in 2024, the highest since 2021, accounting for over one-third of China’s outbound deals.

Media Markt website home page

CSPC Pharmaceutical secures USD 2.1 billion global licensing deal with U.S.-based Madrigal, US FDA approves Changchun High-Tech’s children's hypertension drug (link, link)

CSPC Pharmaceutical Group has secured a USD 2.1 billion global licensing deal with US-based Madrigal Pharmaceuticals for its preclinical oral small-molecule GLP-1 weight-loss drug, SYH2086. Under the agreement, Madrigal will make an upfront payment of USD 120 million, followed by milestone payments and sales royalties that could reach up to USD 2 billion. Madrigal will develop, manufacture, and commercialize SYH2086 worldwide, while CSPC retains rights to other oral GLP-1 agonists in China. The deal is expected to close in Q4 2025. SYH2086 aims to provide an oral alternative to GLP-1 injections like Ozempic and Wegovy, improving patient convenience and compliance. Preclinical data for SYH2086 have shown excellent agonistic activity and favorable pharmacokinetic properties without significant safety concerns. The deal highlights the growing global recognition of Chinese pharmaceutical innovation.

US Food and Drug Administration (FDA) approved a child-friendly hypertension formulation developed by a subsidiary of Changchun High-Tech. The FDA approved amlodipine freeze-dried powder as an oral solution for treating hypertension and angina in patients over six years old. This innovative 505(b)(2) reformulation can lower blood pressure in both children and adults, reducing the risk of cardiovascular events. The approval helps Changchun High-Tech diversify its US product portfolio. Last year, the company received clinical trial approvals in China and implicit permission from the FDA for several other drugs, including treatments for thyroid eye disease and advanced solid tumors.

Three Chinese brands with significant global traction are preparing for IPOs, mirroring the success of companies like Pop Mart, Laopu Gold, and Mixue Bingcheng. Softcare, a leading hygiene products brand in Africa, reported USD 410 million in revenue for 2023, representing a 28.6% year-over-year increase. It operates eight factories and 44 production lines across Africa, with a market share of 20% in baby diapers and 14% in sanitary pads. Dahon, the world's largest producer of folding bicycles, saw a 58.7% revenue increase to USD 49 million in the first nine months of 2024. It holds a 21.1% market share in China and 5.6% globally. Ridge Outdoor, a top fishing gear brand, posted USD 80.2 million in revenue in 2024, with a 23.1% global market share. These brands exemplify China's expanding global influence, with plans to use IPO proceeds for capacity expansion, branding, and R&D.

Finally, a powerful CRM—made simple.

Attio is the AI-native CRM built to scale your company from seed stage to category leader. Powerful, flexible, and intuitive to use, Attio is the CRM for the next-generation of teams.

Sync your email and calendar, and Attio instantly builds your CRM—enriching every company, contact, and interaction with actionable insights in seconds.

With Attio, AI isn’t just a feature—it’s the foundation.

Instantly find and route leads with research agents

Get real-time AI insights during customer conversations

Build AI automations for your most complex workflows

Join fast growing teams like Flatfile, Replicate, Modal, and more.

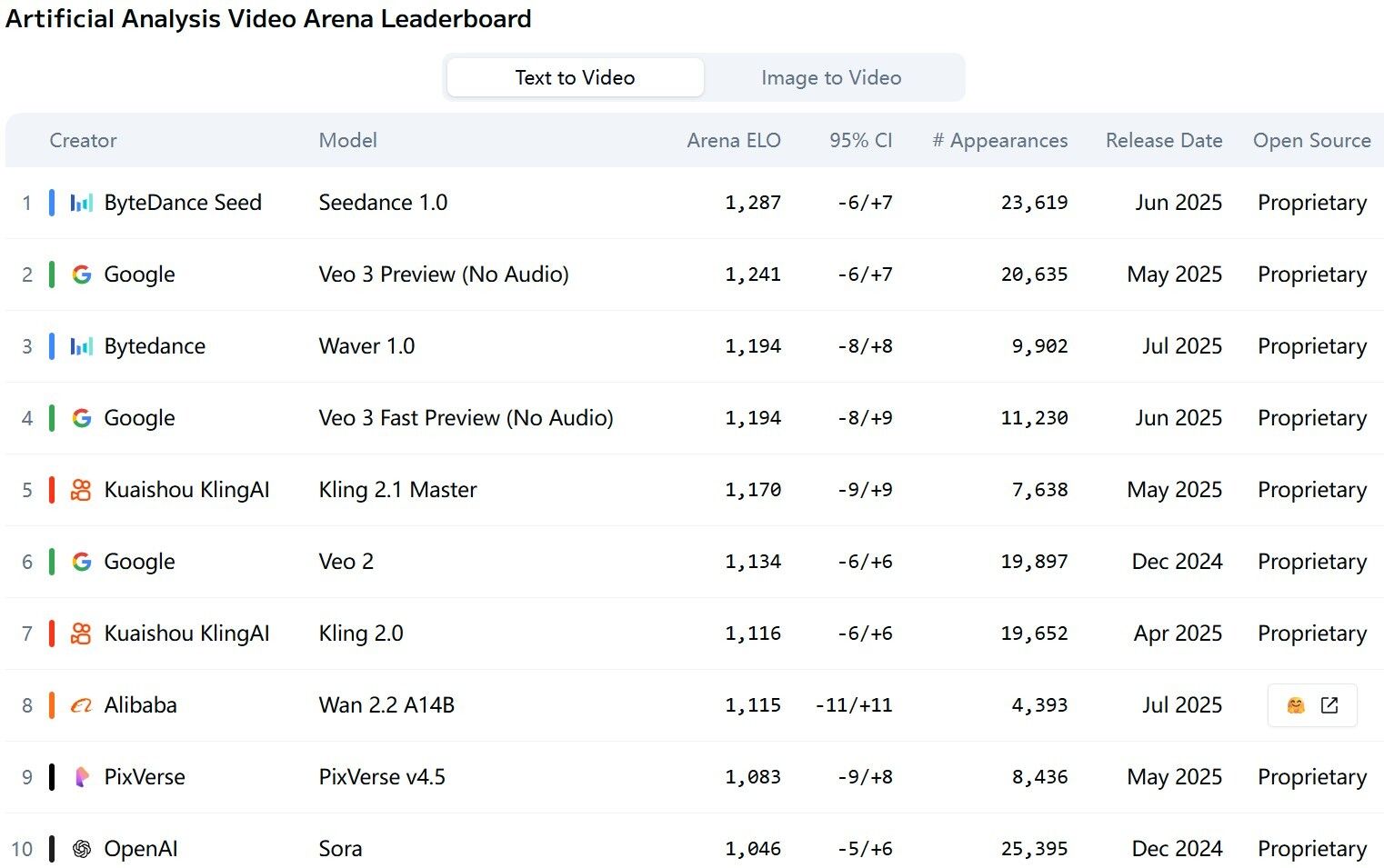

Chinese companies led by ByteDance are leading text-to-video and image-to-video global AI rankings (link)

Chinese companies are leveraging AI to revolutionize video content creation, following the success of TikTok. ByteDance, TikTok's parent company, holds the first and third spots in both Artificial Analysis' top-ranked text-to-video and image-to-video generative AI models. Kuaishou's Kling AI ranks 5th in the text-to-video and 6th in the image-to-video leaderboards, has generated significant revenue, with over 150 million yuan (USD 20.83 million) in the first three months of 2025, and daily advertising spend reaching 30 million yuan. Kling AI supports over 20,000 businesses globally, including advertisers and movie animators. Alibaba has also released its latest video generation AI model, Wan2.2, which allows users to control various aspects of video production. Baidu is set to release its AI-powered digital human technology in October, which generated USD 7.65 million in sales during a livestreaming session. Shanghai-based MiniMax ranks 2nd in the image-to-video rankings. These advancements highlight China's potential to lead the Generative AI revolution in visual digital entertainment.

Thirty-seven Chinese airlines, including Air China, China Eastern Airlines, and China Southern Airlines, have partnered with Umetrip to begin direct ticket sales on the civil aviation information service platform. This move aims to address user concerns related to bundled packages and price hikes on online travel platforms by establishing a direct sales model. Umetrip, a subsidiary of TravelSky Technology, is a state-owned provider of IT services to China's civil aviation and tourism industries, with China Eastern and China Southern among its shareholders. The Civil Aviation Administration of China (CAAC) has noted that airlines heavily rely on third-party distribution channels, which use their user traffic and big data to influence ticket prices, leading to price wars. The key to alleviating low-price competition lies in addressing homogeneous competition from excess capacity, according to industry insiders.

Chinese engineers have unveiled the world’s first brain-like computer, the “Darwin Monkey,” which contains over 2 billion artificial neurons and mimics the macaque monkey brain. Developed by Zhejiang University, this supercomputer is composed of 960 Darwin 3 brain-inspired computing chips, creating over 100 billion synapses. It is designed to advance human brain-inspired AI and has successfully completed tasks like content generation and logical reasoning using DeepSeek’s brain-like large model. The system, which consumes around 2,000 watts of power under typical operating conditions, can also simulate the brains of various animals, potentially advancing brain science research. This development follows the “Darwin Mouse,” a previous brain-inspired computer released in 2020 with 120 million artificial neurons. The Darwin Monkey represents a significant step towards achieving more advanced brain-like intelligence and could pave the way for more efficient and adaptable AI systems.

China installed 268 GW of new renewables capacity in the first half of 2025, nearly doubling year on year, led by solar (link)

China added 268 GW of new renewable energy capacity in the first half of 2025, up 99.3% year-on-year and accounting for 91.5% of all new power installations. Solar contributed 212 GW of the total – 100 GW from utility-scale projects and 112 GW from distributed systems – followed by 51.39 GW of new wind capacity, 3.93 GW of hydropower, and 710 MW of biomass. By the end of June 2025, total installed renewables capacity had reached 2.159 TW, or 59.2% of China’s total power generation capacity. Solar stood at 1.1 TW, wind at 573 GW, hydropower at 440 GW, and biomass at 47 GW. Solar power generation rose 42.9% year on year to 559.1 TWh, with a national utilization rate of 94%.

China has begun constructing its first green hydrogen pipeline, stretching 400 km from Ulanqab (Inner Mongolia) to Beijing, transporting wind-powered hydrogen. Led by Sinopec, the project is approved by the Inner Mongolia Energy Bureau. Once operational, it will supply 100,000 tonnes/year to Sinopec’s Yanshan complex, with plans to expand to 500,000 tonnes. Powered by a 1-GW wind electrolysis plant in Ulanqab, the project supports China’s push to decarbonize heavy industry and build a national hydrogen economy. The hydrogen will be used in refining, chemicals, and other energy-intensive sectors.

📸 China Snapshot

Chongqing is perhaps China’s most 3D city, where skyscrapers rise from riverbanks and bridges slice through mountain valleys. The bright red Qiansimen Bridge, seen here, connects the historic Yuzhong Peninsula with the Jiangbei business district. The bridge carries both cars and Line 6 of the Chongqing Metro, a network famous for passing through apartment buildings and climbing steep terrain. Below the frame, hillside cafés like this one offer some of the city’s best views of its stacked skyline and river traffic.

🎁 Bonus Stories

The Prix Versailles awards, which celebrate excellence in architecture and design, have announced their list of the world’s most beautiful airports for 2025. Leading the list is Yantai Penglai International Airport Terminal 2 in China. The international airport serves the city of Yantai in East China’s Shandong province. The awards are presented by UNESCO and the International Union of Architects. Following in second and third place are Marseille Provence Airport Terminal 1 in France and the Arrivals Terminal at Roland Garros Airport on Réunion Island, respectively.

Yantai Penglai International Airport’s Terminal 2

A China-led deep-sea expedition in the northwest Pacific Ocean has discovered the deepest live habitat ever known, with thriving colonies of tubeworms and molluscs at depths of up to 9,500 meters (31,150 feet). These creatures, found in the Kuril-Kamchatka Trench and the western portion of the Aleutian Trench, survive by synthesizing energy from chemicals like hydrogen sulphide and methane seeping from tectonic plate faults, bypassing the need for sunlight. The mission, using the Chinese submersible Fendouzhe. The discovery challenges current models of life at extreme limits and suggests that such chemosynthesis-based communities might be more widespread than previously thought, given geological similarities with other deep trenches.

☕ Support our work

If you enjoy our newsletter, please consider buying us a coffee to keep us energized in bringing you the latest insights! 🤓☕

👥 About us

China Insights is brought to you by Tomas Kucera, and Yereth Jansen, CEO at Darling Advertising + Design in Shanghai.

Reply