- China Insights Weekly | AI, Innovation, Business & Tech in China

- Posts

- China Sets World Oil Price 🛢️ $1T Hard-Tech Fund 💰 Luxury Food Exports Soar 🍾

China Sets World Oil Price 🛢️ $1T Hard-Tech Fund 💰 Luxury Food Exports Soar 🍾

China Insights Weekly for December 29. Unpacking China’s economic and technological advances.

Welcome back to China Insights Weekly. Here are some of the key highlights for this week’s edition:

China’s drug pipelines go global, rising share of licensing and clinical trials

Foreign companies keep doubling down, local R&D and supply chains deepen

Humanoid robots move into services, rentals scale across major cities

China accelerates space ambitions, record launches and reusable rocket tests

🚀 Headlines

In 2025, China emerged as a significant influencer on global oil prices, challenging the traditional dominance of OPEC+. China’s status as the world’s largest oil importer allowed it to set an effective price floor and ceiling by adjusting the volume of crude oil sent to storage. For the first 11 months of 2025, China had a surplus of about 980,000 barrels per day (bpd), with imports and domestic output totaling 15.8 million bpd, while refinery processing was 14.82 million bpd. This surplus has been used to stabilize prices, with China adding to storage when prices drop and reducing imports when they rise. Estimates suggest China has between 1 billion and 1.4 billion barrels in storage, with plans to add another 500 million barrels to its strategic reserves. If China continues this strategy, it could absorb much of the forecasted surplus in 2026, effectively supporting oil prices but also capping them if imports are trimmed when prices rise too high.

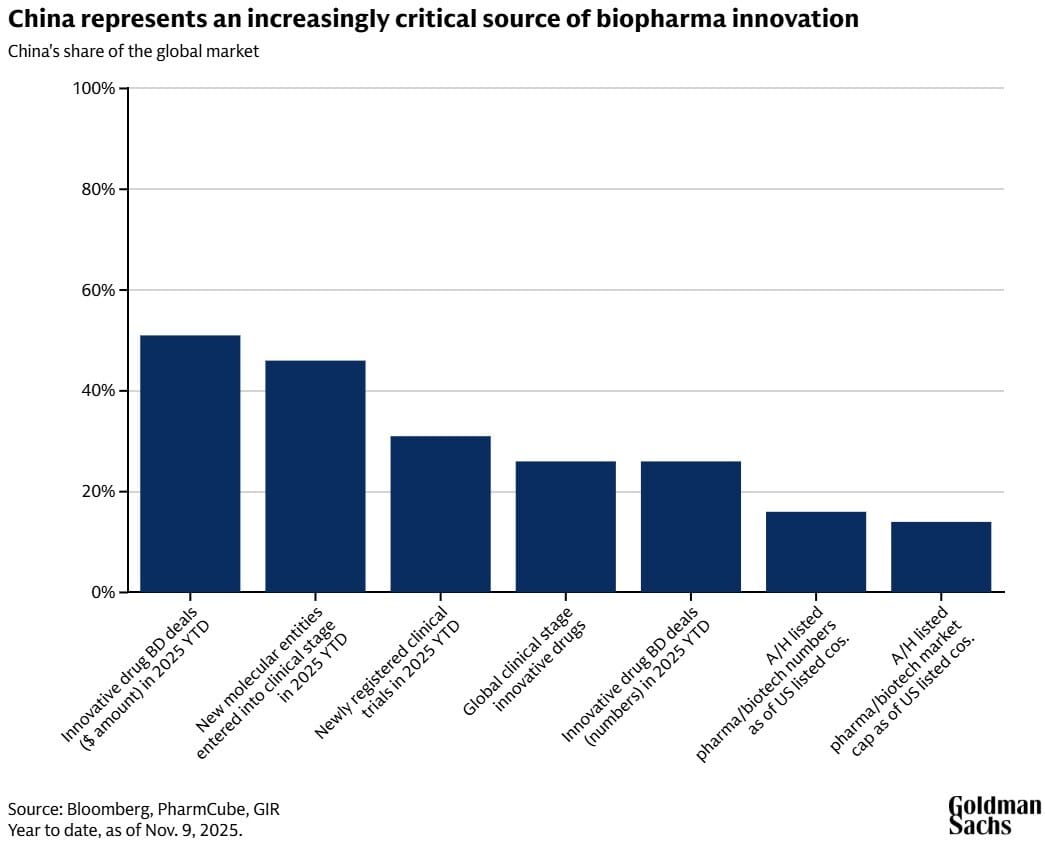

China is emerging as a critical source of biopharma innovation, significantly increasing its share of the global drug development market. As of November 9, 2025, China accounted for a notable portion of global innovative drug business development (BD) deals, both in terms of deal value and number of deals. The country also saw a substantial number of new molecular entities entering the clinical stage and newly registered clinical trials in 2025. China’s A/H listed pharma/biotech companies are growing in number and market capitalization, approaching the levels of US-listed companies. This trend highlights China’s growing influence and competitiveness in the global biopharma sector, driven by increased investment in R&D and a supportive policy environment.

75% of multinationals maintained or increased China investment in 2025, Mercedes invests in smart cockpit firm (link, link)

A recent KPMG survey of 137 senior executives from multinational corporations (MNCs) operating in China found that 75% have maintained or increased their investments in 2025, despite only 52% forecasting revenue growth and 25% expecting negative growth. The survey shows that 83% have localized or plan to localize key aspects of their operations, particularly manufacturing, supply chain, and R&D. MNCs remain more optimistic about China’s economic outlook, with 64% expressing at least moderate confidence in China’s growth over the next three to five years, compared to 42% for the global economy. Digital transformation is a core strategy for over 90% of surveyed companies, with 52% focusing on data analytics, 46% on IT infrastructure, and 36% on emerging technologies. M&A activities have surged, driven by acquisitions in high-performing sectors like EVs, medical technology, and biotech.

German automaker Mercedes-Benz invested CNY 1.3 billion (USD 185 million) for a 3% stake in Chinese intelligent driving technology firm Qianli Technology, becoming its fifth-largest shareholder. The shares were transferred from existing shareholder Lifan Holdings after receiving compliance confirmation from the Shanghai Stock Exchange. The transaction gives Mercedes-Benz a foothold in the Chongqing-based company, which focuses on intelligent assisted driving and smart cockpit technologies. The two companies have signed a long-term strategic cooperation agreement to deepen collaboration in artificial intelligence, intelligent driving, and smart cockpit intelligence.

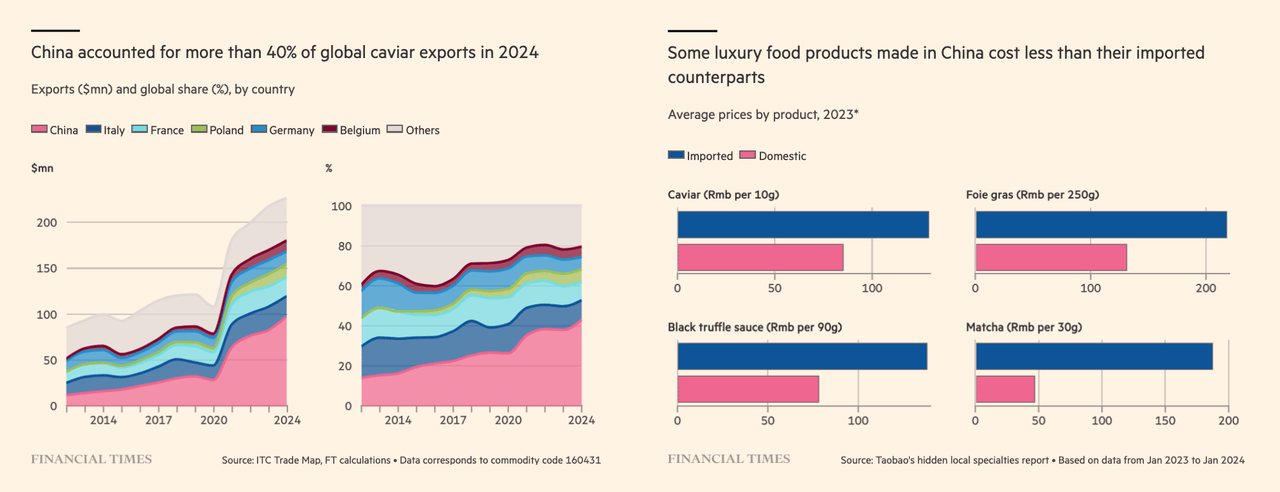

China became dominant producer of luxury foods, including caviar, foie gras, premium cherries, and macadamias (link)

China is rapidly becoming a major producer of luxury foods, including caviar, foie gras, macadamias, premium cherries, and wild truffles, challenging traditional import dominance and driving down prices both domestically and globally. China now accounts for the majority of global caviar production. Kaluga Queen, a brand developed by China's agriculture ministry, has become the world’s largest with about 35% of the world’s market share in 2024. Chinese caviar exports surged from USD 12 million in 2012 to USD 98 million in 2024, capturing 43% of the global market. China is also the world's largest consumer of cherries, projected to consume 1.5 million tonnes in 2025, with 900,000 tonnes grown domestically. Shandong has become China's largest cherry-growing province, driven by local government support. China also surpassed Australia, from whom it originally imported macadamia trees, to become the second-biggest producer of macadamia nuts. This growth is supported by provincial government initiatives in agriculturally rich regions like Yunnan, Shandong, and Anhui, which encourage farmers to switch to higher-value crops.

China has launched a National Venture Capital Fund and three regional funds to mobilize 1 trillion yuan to support companies in strategic emerging and future industries. The National Start-up Investment Guidance Fund is backed by CNY 100 billion from the Ministry of Finance, through ultra-long special sovereign bonds. Each of the three regional funds is expected to grow beyond CNY 50 billion. The national fund will run for 20 years, with 10 years devoted to investment and another 10 to exits. Seed and start-up firms will account for at least 70% of the national fund's investments, targeting smaller companies with valuations of no more than CNY 500 million, and each deal will be capped at CNY 50 million. The fund will prioritize strategic emerging and future industries, including integrated circuits, quantum technology, biomedicine, brain-computer interfaces, and aerospace sectors. The fund is expected to fill funding gaps in capital-intensive hard-tech sectors with long development cycles. It is expected to encourage China's venture capital sector to act as a unified national market.

Reply