- China Insights Weekly | AI, Innovation, Business & Tech in China

- Posts

- Alibaba AI Dominates 🤖 Rocket Factories Challenge SpaceX 🚀 Record Magnetic Field ⚡

Alibaba AI Dominates 🤖 Rocket Factories Challenge SpaceX 🚀 Record Magnetic Field ⚡

China Insights Weekly for October 5. Unpacking China’s economic and technological advances.

Welcome back to China Insights Weekly. Here are some of the key highlights for this week’s edition:

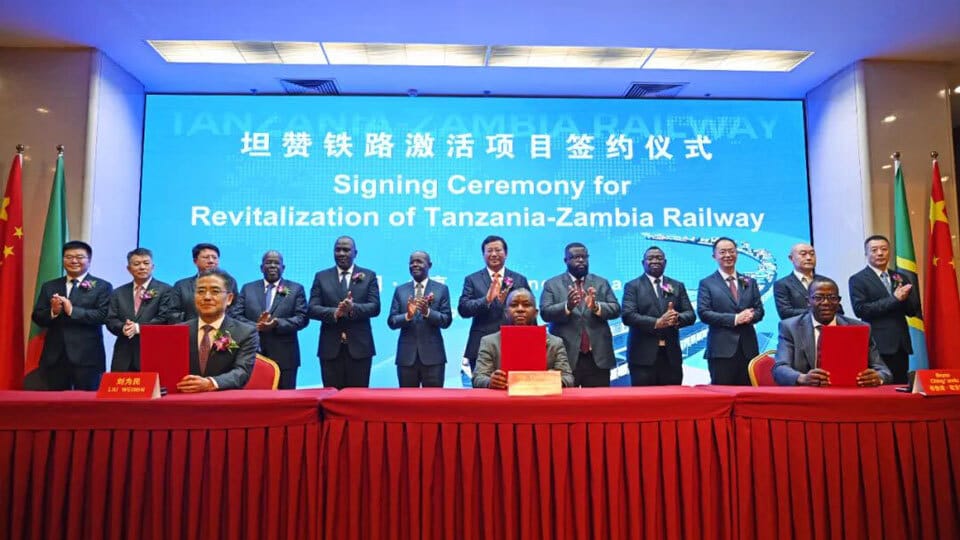

China revives USD 1.4B Tazara railway, linking Zambia and Tanzania for regional trade

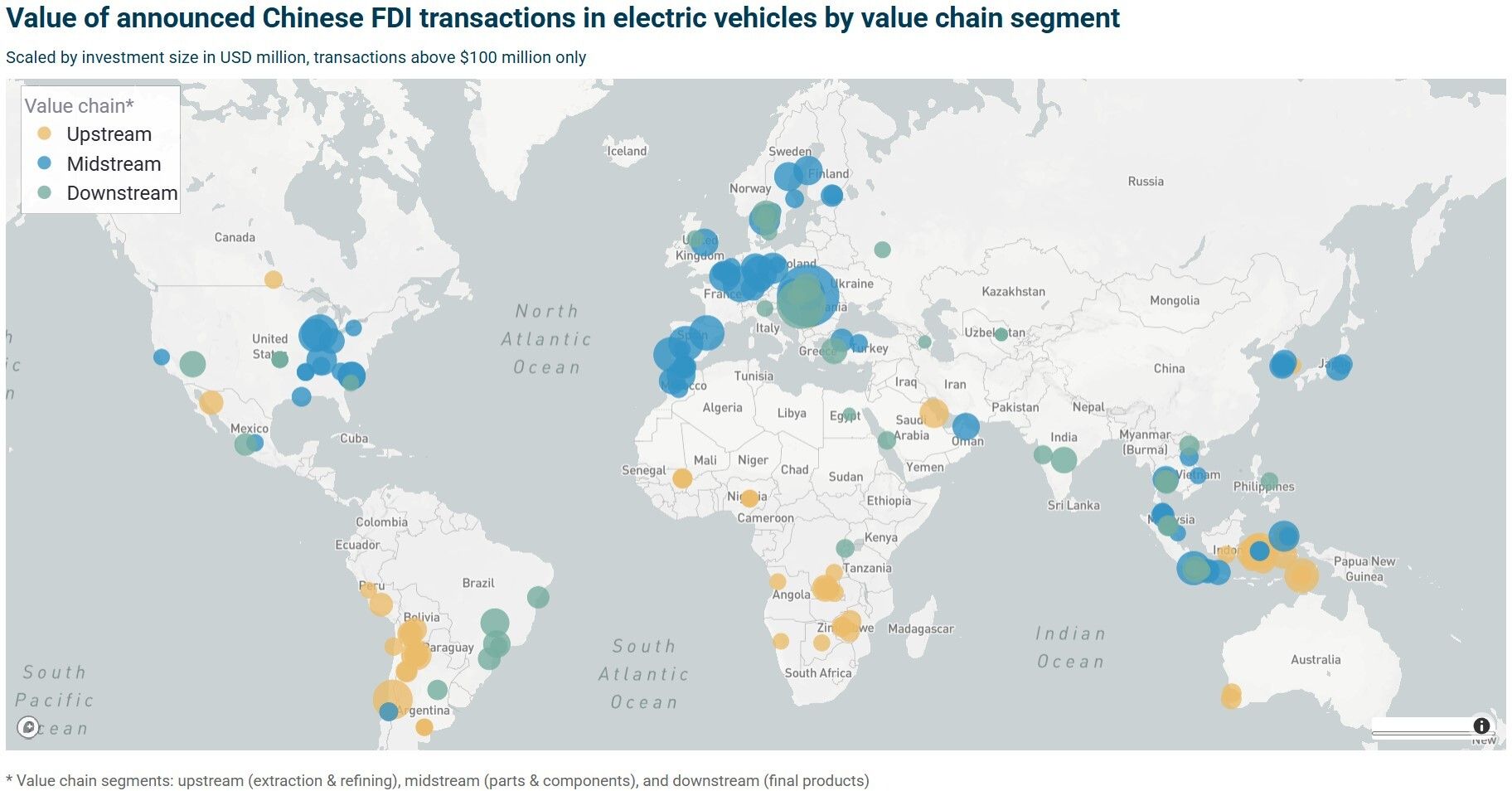

EV investment shifts abroad, with Chinese firms targeting Asia and the Middle East

China completes USD 41B consumer trade-in program, spurring trillions in new sales

Reverse brain drain accelerates, as top US scientists relocate to Chinese research hubs

🚀 Headlines

Alibaba's Qwen AI models top open sources rankings with 5 in top 10, DeepSeek launches new experimental model (link, link)

Alibaba's Qwen3-Omni multimodal AI system has topped Hugging Face's trending model list. Qwen3-Omni-30B-A3B, ranked first, followed by Qwen-Image-Edit-2509. Alibaba's open-source models now account for half of the top 10 spots on Hugging Face, with Chinese firms Tencent, DeepSeek, and OpenBMB occupying four more spots, leaving IBM as the sole Western representative. Alibaba has released over 300 open-source AI models, supporting more than 170,000 derivative models, making it the world's largest open-source AI ecosystem. According to the American Truly Open Models (ATOM) Project, Alibaba's Qwen has surpassed Meta's Llama in popularity. The ATOM Project notes that Chinese open models are gaining market share, leading to an increase in derivative models and outperforming US counterparts.

Chinese startup DeepSeek has launched DeepSeek-V3.2-Exp, an experimental AI model aimed at increasing efficiency and reducing costs. The model introduces a new feature called DeepSeek Sparse Attention (DSA), which allows the AI to handle long documents and conversations more effectively while halving the operational costs compared to its predecessor. This advancement makes powerful AI more accessible to developers, researchers, and smaller companies. Sparse attention filters out less important data, enhancing efficiency but raising concerns about potential oversights in data exclusion. DeepSeek claims the model performs on par with its previous version. The model is designed to work seamlessly with Chinese AI chips, such as Ascend and Cambricon, and the company has shared the programming code openly, allowing others to build upon it.

Zambia, China, and Tanzania have signed a USD 1.4 billion agreement to revitalize the Tazara Railway, one year after a memorandum of understanding (MOU) was signed. Built by China in the 1970s, the strategic line links Zambia to Tanzania and runs to the port of Dar es Salaam. The project includes an initial investment of USD 1.1 billion and USD 238 million in reinvestments. The works will cover the rehabilitation of 1,860 km of the railway track from Dar es Salaam in Tanzania to Kapiri Mposhi in Zambia and the delivery of 34 new locomotives, 16 passenger coaches, and 760 wagons. The agreement also grants China’s state-owned China Civil Engineering Construction Corporation (CCECC), a subsidiary of China Railway, a 30-year concession to manage the railway. The project aims to boost regional integration, economic growth, and shared prosperity. It will also provide a lifeline for farmers, traders, and industries, connecting them to markets across borders. The initiative is expected to create jobs and strengthen regional ties.

Chinese electric vehicle investments go global with geographic focus moving from Europe to Asia, Middle East and North Africa (link)

China's electric vehicle (EV) industry is experiencing significant overcapacity, with battery production in 2024 doubling domestic demand and 20% greater than global demand. This has led to a 90% collapse in new domestic investment. To escape domestic price wars, Chinese firms are accelerating globalization. Outbound foreign direct investment (OFDI) in the EV value chain surged from an annual average of USD 8.5 billion in 2018–2021 to USD 30.4 billion in 2022–2024. In 2024, for the first time, Chinese EV investment was greater overseas than domestically. Announced EV investments have dropped nearly 50% since 2022–2023, but the share of completed Chinese FDI in EVs continues to grow, reaching 25% in 2024. The geographic focus is shifting from Europe (41% before 2024) to Asia (33%) and the Middle East and North Africa (MENA) region (25%). Chinese investment is diversifying across the EV value chain, with firms increasingly establishing overseas facilities for battery materials and vehicle components. Private firms dominate, accounting for over 85% of total investment, with the top five investors representing 38% of total value and CATL alone responsible for nearly 11%.

India and China to resume direct flights, Tesla starts exports of Shanghai-made cars into India (link, link)

India and China will resume direct passenger flights by the end of October 2025, ending a five-year suspension. The flights will operate between select cities, subject to the commercial decisions of designated carriers from both countries. This move follows diplomatic efforts to normalize bilateral relations, including the resumption of visa issuance and high-level meetings. Major carriers like IndiGo plan to restart routes, with Kolkata-Guangzhou flights beginning on October 26. The suspension of direct flights began in early 2020 due to the COVID-19 pandemic and a border clash. The resumption marks a significant step in rebuilding ties between the two nations.

Tesla has officially begun customer deliveries in India, with the first batch of vehicles manufactured at its Shanghai Gigafactory. The Model Y is Tesla’s initial offering in India, starting at USD 69,000 for the rear-wheel drive version and USD 79,000 for the long-range version. These prices are significantly higher due to India’s 70% import tariff on electric vehicles. Tesla opened its first Indian showroom in July, marking its entry into the world’s third-largest automotive market. The luxury vehicle segment represents only 1% of total sales in India.

Reply